The creator economy isn’t a niche anymore—it’s a $500B+ industry that’s only growing. Millions of people are making a living from YouTube, TikTok, podcasts, brand deals, digital products, subscriptions, and more.

But while creators are rewriting the rules of work, one part of the system hasn’t kept up: traditional banking.

Most banks still run on old-school assumptions—that everyone has a 9-to-5, a W-2, and predictable paychecks every two weeks. For creators, that model just doesn’t fit. And when your bank doesn’t understand how you earn, it becomes harder to grow, save, and thrive financially.

That’s why we built Bump: creator-first banking that actually matches the way you work and earn.

Here are 4 reasons traditional banks don’t work for creators—and how Bump does things differently.

1. Traditional Banks Rely on W-2s and Pay Stubs

If you’ve ever applied for a loan, mortgage, or even a credit card, you’ve probably been asked for a pay stub. But what happens when your income comes from multiple sources—brand deals, platform payouts, Patreon, merch, or consulting?

For many creators, this means being seen as “unreliable” or “high-risk,” even if you’re earning more than the average salaried worker.

What Bump does differently: We recognize all your income streams—whether it’s from TikTok, Substack, Spotify, or a brand partnership. Your work is valid, your revenue is real, and your bank should treat it that way.

2. Traditional Banks Treat You Like a Hobby, Not a Business

Creators aren’t just making content—they’re running full-fledged businesses. From managing invoices and expenses to scaling their brands, creators juggle responsibilities that look a lot like entrepreneurship.

Yet, most banks don’t provide the tools you need to operate like a business. Instead, they offer generic checking accounts and outdated services.

What Bump does differently: We give you business-minded tools like savings features, funding opportunities, and financial wellness resources designed for creators at every stage—from side-hustlers to full-time entrepreneurs.

3. Traditional Banks Don’t Solve Inconsistent Income

Let’s be real: creator income doesn’t always flow evenly. Some months, a viral hit or big deal can set you up. Other months may feel slower.

A 2023 survey showed that 60%+ of creators list inconsistent income as their top financial stress. Traditional banks don’t address this problem—they just penalize you when your cash flow looks “irregular.”

What Bump does differently: We help smooth the ups and downs by giving you visibility into your money, tools for saving during peak months, and smarter insights to keep your business stable—even when income shifts.

4. Traditional Banks Lack Creator-First Insights

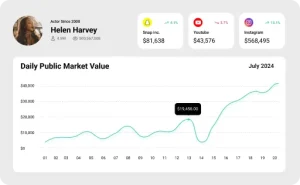

Banks may know your credit score, but they don’t know your true market value. As a creator, your audience, influence, and brand partnerships are just as important as your credit history.

Without those insights, it’s hard to negotiate confidently or understand your growth potential.

What Bump does differently: Bump provides real-time data on your market worth—helping you negotiate brand deals with confidence, set fair rates, and plan your financial future with accuracy.

The Bottom Line

Traditional banks weren’t built for creators. They were built for a world of W-2s, 9-to-5 paychecks, and outdated rules that don’t apply in the creator economy.

Creators deserve tools that are just as innovative and flexible as the work they’re doing.

That’s why Bump exists.

We’re here to help you know your worth, grow like a business, and stress less about money.

👉 Ready to experience creator-first banking? Learn more at usebump.com